- Browse

- Taxation

Taxation Courses

Taxation courses can help you learn tax compliance, income tax preparation, corporate taxation, and international tax law. You can build skills in tax planning, understanding deductions and credits, and navigating tax regulations effectively. Many courses introduce tools like tax software, spreadsheets for financial analysis, and resources for staying updated on tax legislation, that support applying your knowledge in practical work.

Popular Taxation Courses and Certifications

U

UUniversity of Illinois at Urbana-Champaign

Skills you'll gain: Data Visualization, Data Storytelling, Management Accounting, Fund Accounting, Operations Management, Mergers & Acquisitions, Financial Statement Analysis, Credit Risk, Project Closure, Machine Learning Algorithms, Business Strategy, Risk Management, Social Determinants Of Health, Revenue Recognition, Financial Auditing, Entrepreneurship, Data Governance, Generative AI, Supply And Demand, Statistical Inference

Credit offered

Graduate Certificate · 6 - 12 Months

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Pennsylvania

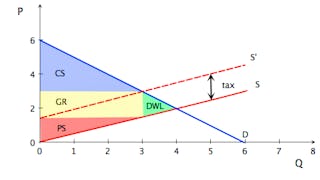

Skills you'll gain: Supply And Demand, Economics, Market Dynamics, Market Analysis, Resource Allocation, Policy Analysis, Tax, Consumer Behaviour, Cost Benefit Analysis, Decision Making

4.7·Rating, 4.7 out of 5 stars1.7K reviewsMixed · Course · 1 - 3 Months

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Balance Sheet, Financial Statements, Management Accounting, Performance Measurement, Income Statement, Financial Statement Analysis, Cost Accounting, Capacity Management, Financial Reporting, Asset Management, Organizational Strategy, Performance Analysis, Financial Accounting, Financial Analysis, Budgeting, Operational Analysis, Business Metrics, Accounting, Budget Management, Small Business Accounting

4.6·Rating, 4.6 out of 5 stars2K reviewsBeginner · Specialization · 3 - 6 Months

Status: PreviewPreviewI

Status: PreviewPreviewIIndian School of Business

Skills you'll gain: Loans, Financial Planning, Wealth Management, Financial Management, Budgeting, Tax Planning, Investments, Economics, Income Tax, Risk Management

4.4·Rating, 4.4 out of 5 stars16 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialJ

Status: Free TrialFree TrialJJohns Hopkins University

Skills you'll gain: Medical Billing and Coding, Denial Management, Patient Registration, Revenue Cycle Management, ICD Coding (ICD-9/ICD-10), Payment Processing and Collection, CPT Coding, Medical Billing, Medical Coding, Billing, Revenue Management, Managed Care, Medicare, Medicaid

4.9·Rating, 4.9 out of 5 stars61 reviewsBeginner · Course · 1 - 4 Weeks

A

AAlfaisal University | KLD

Skills you'll gain: Standard Accounting Practices, Accounting, Financial Statements, General Accounting, Financial Reporting, Bookkeeping, Generally Accepted Accounting Principles (GAAP), Financial Accounting, International Financial Reporting Standards, Income Statement, Balance Sheet

4.8·Rating, 4.8 out of 5 stars81 reviewsBeginner · Course · 1 - 4 Weeks

Status: NewNewStatus: Free TrialFree Trial

Status: NewNewStatus: Free TrialFree TrialSkills you'll gain: Working Capital, Balance Sheet, Income Statement, Financial Reporting, Case Studies, Operational Efficiency, Return On Investment, Corporate Tax

Mixed · Course · 1 - 4 Weeks

Status: Free TrialFree Trial

Status: Free TrialFree TrialSkills you'll gain: Goal Setting, Budgeting, Tax, Financial Planning, Cash Flow Forecasting, Financial Analysis, Credit Risk, Expense Management, Asset Management, Decision Making, Self-Awareness

4.6·Rating, 4.6 out of 5 stars236 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Fund Accounting, Governmental Accounting, Financial Reporting, Non-Profit Accounting, Accounting, Generally Accepted Accounting Principles (GAAP), General Ledger, Financial Statements, Cash Flows, Accrual Accounting, Revenue Recognition, Depreciation, Reconciliation, Budgeting, Accountability

4.8·Rating, 4.8 out of 5 stars10 reviewsIntermediate · Course · 1 - 3 Months

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Pennsylvania

Skills you'll gain: Compliance Management, Law, Regulation, and Compliance, Legal Risk, Business Ethics, Internal Controls, Risk Analysis, Risk Mitigation, Ethical Standards And Conduct, Risk Management, Due Diligence, Employee Training, International Relations, Operations Management, Strategic Planning, Case Studies

4.9·Rating, 4.9 out of 5 stars682 reviewsMixed · Course · 1 - 4 Weeks

Status: FreeFreeW

Status: FreeFreeWWesleyan University

Skills you'll gain: Court Systems, Civil Law, Legal Proceedings, Litigation and Civil Justice, Property and Real Estate, Economics, Technology Strategies, Compensation Management, Case Studies

4.6·Rating, 4.6 out of 5 stars557 reviewsMixed · Course · 1 - 3 Months

Status: Free TrialFree TrialP

Status: Free TrialFree TrialPPwC India

Skills you'll gain: Sales Tax, Tax Compliance, Tax Laws, Tax Management, Regulatory Compliance, Commercial Laws, Financial Services, Registration, Problem Solving

4.5·Rating, 4.5 out of 5 stars81 reviewsBeginner · Course · 1 - 4 Weeks

Searches related to taxation

In summary, here are 10 of our most popular taxation courses

- CPA Pathways Graduate Certificate: University of Illinois at Urbana-Champaign

- Microeconomics: The Power of Markets: University of Pennsylvania

- Fundamentals of Accounting: University of Illinois Urbana-Champaign

- Basic Financial Literacy: Indian School of Business

- Revenue Cycle, Billing, and Coding : Johns Hopkins University

- مبادئ وأساسيات المحاسبة | What Accounting is all about: Alfaisal University | KLD

- Financial Analysis & Tax Accounting: Apply & Evaluate: EDUCBA

- Introduction to Personal Finance: SoFi

- Governmental Accounting and Reporting I : University of Illinois Urbana-Champaign

- What is Corruption: Anti-Corruption and Compliance: University of Pennsylvania